Financial Details

|

Column

|

Notes

|

|

Current Cost*

|

The current cost can be positive, zero, or negative. Assets defaults a cost of zero for CIP assets and you cannot change it. Assets automatically updates the cost to the sum of the invoice line costs in the Source Lines window.

|

|

Original Cost

|

Assets displays the original cost of the asset and updates it if you make a cost adjustment in the period you added the asset. After the first period, Assets does not update the original cost

|

|

Date Placed in service*

|

See below

|

|

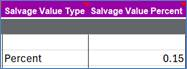

Salvage Value Type

|

Indicates the way to determine salvage value.

Amount - Manually enter the salvage value manually

Percent – Salvage Value Percentage field determines the Salvage value.

|

|

Salvage Value Percentage

|

Percentage to use to calculate Salvage Value Amount

Enter value between 0-1 i.e. 0.15 = 15%

|

|

Salvage Value Amount

|

Manual amount

|

|

Depreciate

|

Indicates whether the asset is depreciating.

YES - Asset is depreciating

NO - Asset is not depreciating

|

|

Method

|

The depreciation method you choose determines the way in which Assets spreads the cost of the asset over the time it is in use. This will default from the Category if you don’t specify.

|

|

Life in Months

|

Life in years should be converted to months e.g. 1year 6mths would be entered as 18.

Only months setup on your system will be listed.

|

|

Basic Rate

|

If the (depreciation) Method Type is Flat the Basic and Adjusted Rates can be selected and used for depreciation calculations

|

|

Adjusted Rate

|

As for Basic Rate

|

|

Prorate Convention

|

Assets uses the prorate convention to determine how much depreciation to take in the first and last years of asset life. Will default from Category if not specified.

|

|

Prorate Date

|

Assets determine the prorate date from the date placed in service and the prorate convention. It uses this date to determine how much depreciation to take during the first and last years of asset life. Will default.

|

|

YTD Depreciation

|

Used if the DPIS is before the current period but in the current financial year. The create process will calculate this value basic on DPIS, Prorate Convention and Depreciation Method.

|

|

Depreciation Reserve

|

Also known as Accumulated Depreciation. If DPIS is in previous financial years, then this represents all depreciation so far.

|

|

Net Book Value

|

The net book value is defined as:

Net Book Value = Current Cost – Total Reserve (Accumulated Depreciation + Bonus Reserve)

|

‘*’ Required

Date Placed in Service (DPIS)

If the current date is in the current open period, the default DPIS is the calendar date you enter the asset.

If the calendar date is before the current open period, the default date is the first day of the open period.

If the calendar date is after the current open period, the default date is the last day of the open period.

Accept this date or enter a different DPIS in the current accounting period or any prior period.

You cannot enter a DPIS before the oldest DPIS you specified in the System Controls window.

You can change the DPIS at any time. If you change the DPIS after depreciation has been processed for an asset, Assets treats it as a financial adjustment, and the accumulated depreciation is recalculated accordingly. The asset category, book, and DPIS determine which default depreciation rules Assets uses. If the asset category you entered is set up for more than one DPIS range for this book, the DPIS determines which rules to use.

If you enter a DPIS in a prior period and zero accumulated depreciation, Assets automatically calculates catchup depreciation when you run depreciation and expenses the catchup depreciation in the current period.

The DPIS for CIP assets is for your reference only. Assets automatically updates this field to the date you specify when you capitalize the asset using the Capitalize CIP Assets window."

Defaulting from Category

To summarize, many fields will default from the Category, including

● Salvage Value type/Percent/Amount

● (Depreciation) Method/Life in Months/Basic Rate/Adjusted Rate

● Prorate Conversion and Date

After you have created your asset, you will need to download to confirm all the defaults that have been applied.

Percentage Values

The format of percentage fields is often confusing. If you wish to use a percentage then the field will expect a valve between 0 and 1. For example, if you enter 0.5, it corresponds to 50%.

Salvage Value Percent example:

YTD Depreciation and Depreciation Reserve

If you enter a DPIS in a prior period and zero accumulated depreciation, Assets automatically calculates catchup depreciation when you run depreciation and expenses the catchup depreciation in the current period

Sections: